Get instant access

Plus receive unlimited tutor support via phone & email from experienced professionals.

Improve your accounting career

Be awarded with an industry-recognised certificate of achievement on completion of this course.

Improve your career prospects from just $25 per week.

By completing this course, you will be on your way to becoming an ACCA member, after finishing the 10 Exams, an online EPSM module, and the Professional Bodies standard of 36 months experience, you’ll be recognised as a financial expert with highly sought after professional skills and ethical values. ACCA Membership give access to…

At The Career Academy, we understand the importance of thorough preparation and continuous professional growth for ACCA students. That’s why we’re proud to offer a comprehensive suite of free ACCA resources, meticulously designed to support your journey from the classroom to the boardroom.

Held four times a year, with options to sit at a test centre or remotely.

Recommended before Strategic Professional Exams.

36 months of supervised experience in a relevant role.

Access a full Syllabus, short quizzes, and flash cards to help prepare you for your exams

Track your performance, with these support tools to help set, assign, and mark practice content

Engage with our dynamic multimedia content for insightful learning on the go.

Your personal study planner, guiding you through your ACCA journey with customized study schedules.

The Advanced Certificate in Accounting includes learning across basic, advanced, management, and taxation accounting – plus, you will enhance your task management abilities and undertake an accounting skill assessment. View the modules below.

Students will develop knowledge and skills relating to the tax system as applicable to individuals, single companies and groups of companies.

We’re an internationally recognised online education provider, who partners with industry to deliver you the latest and most up to date content. We have over 15 years experience in online education and help change the lives of over 20,000 students every single year.

Our professional tutors at The Career Academy are industry experts who are passionate about helping students succeed. They’re committed to providing exceptional online course support and personal tutoring to help you succeed. Throughout your course, you’ll receive unlimited tutor support via phone and email.

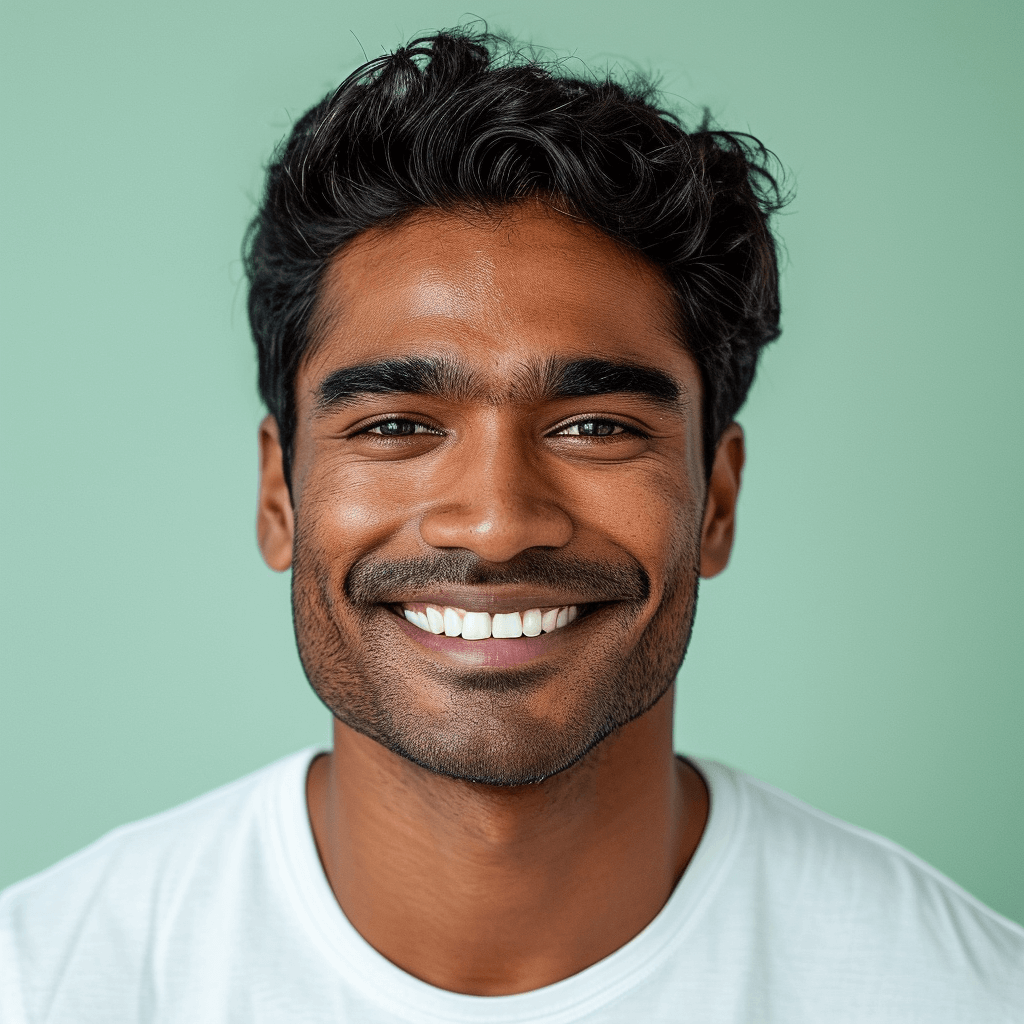

After graduating from The University of Auckland, Bhavik came to us as one of our resident Accounting tutors where he amazes both his students and colleagues with his huge range of knowledge. Bhavik has been with us for two years and we’re still trying to find a topic that he’s not an expert in. So far we know he’s a pro at web development, IT, simulation racing, and guitar, so who knows what other talents he’s hiding from us.

While tutoring, Bhavik loves that every student is unique which means he can tailor his tutoring style to each one. He says its especially rewarding when he sees a less confident student develop over the course of their learning.

Tracey is a people person with impressive juggling skills. Like many of The Career Academy’s students, she’s a working mum balancing her job and her family.

In her previous role as an office manager at one of Lion Nathan’s Auckland establishments for seven years, she was responsible for all manner of financial duties (incl. payroll, and accounts payable & receivable.) She later backed up these skills with a Bachelor of Business from Massey.

Although she’s a proficient “number cruncher” it’s working with her students which Tracey enjoys the most. Seeing when a student really “gets it,” when their confidence soars or when they’re able to secure that new role – these are things that she loves.

Ryan is an Accounting Tutor at The Career Academy with a Bachelors’s in Accounting and Economics from the Auckland University of Technology, New Zealand. Ryan enjoys inspiring students and loves passing on his knowledge of Accounting. Many years of education have taught him that every student learns differently, which puts him in an excellent position to tailor his teaching for an exciting student learning experience.

Besides Accounting, Ryan loves traveling and watching Premier League football, as he was a football player in his school days. Ryan loves helping people achieve their goals and success in their career.

Anna is a Tutor at The Career Academy and has a strong background in hands-on accounting and bookkeeping after several years working in this area. One of her favourite quotes is, “Education is the difference between wishing you could help other people and being able to help them”- Russell M Nelson. Anna feels that education is the foundation of growth, and she is committed to helping students, whatever their abilities, achieve their learning goals.

Anna graduated from Auckland University of Technology with a Bachelors in Business, majoring in Accounting & International Business, and she enjoys using her experience, together with her passion for learning, to be a positive influence on our students.

When Anna isn’t helping students, you can find her with her family and in her garden.

Md brings over 10 years of diverse experience spanning aviation, HR, retail, and education to the world of finance and accounting. With notable positions at esteemed organizations such as Biman Bangladesh Airlines, Impact College, and Tech Mahindra, he has honed his expertise.

Md holds MBA degrees from both the University of Chester and the University of Dhaka, enabling him to take a strategic approach to teaching accounting and finance concepts. His proficiency in financial analysis and forecasting ensures that he delivers dynamic and practical lessons.

Prior to his role at The Career Academy, Md served as the Financial Accounts Manager at Impact College, where he oversaw critical functions like internal audits and budgeting. He integrates this hands-on experience into his tutoring, bridging the gap between theory and real-world scenarios.

As a mentor, Md guides students through intricate topics such as bookkeeping processes, VAT compliance, payroll management, financial,and management reporting, guaranteeing comprehensive learning. His systematic teaching style and exceptional communication skills make complex financial subjects more accessible.

Driven by his passion for inspiring students, Md promises an enriching and value-driven learning journey. With his multifaceted expertise, he offers well-rounded support to learners.

I obtained a Bachelor of Business Studies majoring in Accounting from Waikato Institute of Technology. During my time studying, I mentored several international students in a range of topics including commercial law, marketing, accounting & finance. Not only did this give me lots of energy watching my students grow, it also deepened my understanding of these topics as well as how to relate to people.

It is no surprise that I came to The Career Academy – with a teacher for a mother, it’s just in my blood.

Outside of work, I like to relax by playing football with my teenage sons, dance to Baila music, read, or cook delicious meals with my wife.

Dedicated professional with a passion for continuous learning and adaptability. Excels in leveraging diverse skills to tackle challenges and contribute to collaborative team environments. Committed to achieving goals and driving success through innovation and effective communication.

The Career Academy’s Accounting program opens doors to significant roles in both small businesses and large multinational companies. Our focus is on making you career-ready, preparing you for key positions such as:

From 2021 to 2026, the Australian market for accounting-related jobs is projected to grow by 9.2%, leading to significant opportunities in the field resulting in:

Sources: Seek, Labour Market Insights

The Career Academy is committed to helping you on your pathway to success. We believe by utilising The Career Centre’s resources and connections, you’ll gain confidence and the networks you need to get a new job or promotion.

Once enrolled with us, you will get instant access to our Career Centre and benefit from:

The Greeks are no strangers to an Odyssey, but George started one of his own when he uprooted from Greece and moved his family halfway across the world in 2012. “I think the transition has been easier for our boys than for my wife and I.” he says. “They’re younger and they’re surrounded by English-speakers at school every day. They often correct our English – but that’s good, it helps us improve even more!”

With more than 20 years professional experience as a Dentist, George found that his Greek qualifications weren’t recognized globally, and that re-qualifying would be like pulling teeth – literally. Instead of dealing with the arduous, lengthy, and expensive process of re-qualifying, George decided to take his first tentative steps in a new career.

At first, George was considering a career in tourism, but considering that “I’m not in my twenties anymore,” and that he had a proven record of business acumen, he instead opted to begin a career in accountancy. Attending polytechnic was not appealing; it was more costly than online learning, and would seriously cut into the hours where George could be earning an income.

So, he searched online and found The Career Academy’s Certificate in Accounting. From his first phone call, it was obvious George had made the right choice. Amy (his one-on-one student advisor) was patient and kind on the telephone, carefully answering his questions, explaining how online learning would look (you can see it for yourself here), and letting him know he’d be supported every step of the way.

Studying around his temporary job at a fast-food restaurant, George successfully completed the 140 hour course in just seven weeks. George’s online experience at The Career Academy was so good, he decided to take a second course, this time in the Advanced Certificate in Accounting, which expands on the core concepts he learned while studying the Certificate. Ultimately, George has his sights set on becoming an Accounting Technician, and he likely won’t be far away with the certificate’s endorsement by the International Association of Accounting Professionals. The course also includes up to six months access to MYOB and allows students to receive the official Xero Advisor Certification, so George will be well equipped with the tools of the trade.

George’s Odyssey is far from over, but if you want to follow in his footsteps check out the Certificate or Advanced Certificate in Accounting and you can get started immediately.

The Career Academy will cover your first years subscription (you’ll be required to pay in subsequence years). To become a full member of the ACCA, you will need to finance the costs of your exams and EPSM fees at an additional cost of ~$3,355 (paid to ACCA) upon completion of this course.

*Note that Chartered Certified Accountant is a different certification to a Chartered AccountantRegistration Fee

~$172

Exemption Fee x3

~$498

1st year subscription to ACCA Subscription

~$259

~$275

~$275

~$275

~$275

~$275

~$275

~$487

~$358

~$358

~$358

~$145

*Your exam fees will be paid for in pounds (£), Conversion rates may change

Whether you prefer to pay upfront, weekly, fortnightly, or even monthly, we’ve got you covered. With our flexible payment options, you’ll have the freedom to choose the payment frequency that works best for you. No matter your budget or schedule, we’re here to make education affordable and accessible for you.

Pay Upfront & Save

Unlock savings when you pay your course fees via one full payment.

$3,450.00

Cost effective option – save $455!

One-off up-front payment

7-day Money Back Guarantee

Receive free printed course notes

Interest FREE Payment Plan

Weekly option for budget-conscious students.

Per-week

Budget friendly option with flexibility in payments

Pay weekly, fortnightly, or monthly

No deposit, no credit check

At The Career Academy, we’re committed to providing you with the tools and resources you need for both exam success and career advancement. Join us in this journey of professional excellence with ACCA.

You can enrol online by selecting “Enrol Now” and following the step-by-step instructions. Alternatively, you can enrol by phone or email through our student advisory team at 1800 837 550 or info@thecareeracademy.com.au.

The course fee is $2,995 + GST, with a flexible payment plan available at $25 per week. Additionally, there are fees for the 10 ACCA exams. For detailed cost breakdowns, please contact a student advisor for a full breakdown

The course is designed to be completed in approximately 400 hours, with a maximum timeframe of 18 months allowed for completion.

Whilst Studying you will be considered an ACCA Student.

Once you finish the 10 exams you will be an ACCA Affiliate.

After 36 months of experience working, you will become an ACCA Member.

Yes, this course can serve as a pathway to Bachelor’s or Degree programs. For instance, Unitec recognizes credits from this course towards their Bachelor of Business. Additionally, you may qualify for Recognition of Prior Learning (RPL) if you already possess relevant qualifications or experience.

Graduates typically find positions as Accounting Technicians, involved in tasks like preparing accounts, managing payroll, and general bookkeeping. Contact us at 1800 837 550 for more details on career outcomes and to receive a FREE CV review.

Your course is delivered through our online learning platform, which you can access from any web browser 24/7 to work whenever and wherever you want. You can also interact with your tutors and other students within the learning environment. Online learning allows you to make the best use of your time and puts all the necessary resources at your fingertips. There are no set course start dates; you can start whenever you are ready, and your tutors and student services will check in on your progress and help you every step of the way.

Watch this video to see how online learning works:

Yes, we offer a 7-day cooling-off period at the start of the course during which you can assess the learning materials. If you decide the course isn’t right for you within this period, you are eligible for a full refund.

Completing this program, including the CAT certification with IPA, qualifies you for exemptions in three ACCA papers: